A 501(c)3 Non-Profit Organization Serving Greater Phoenix & Canyon Corridor

Volunteer Income Tax Assistance Program

Rehoboth CDC partners with the IRS and volunteers to provide free tax preparation services for low and moderate-income, disabled, limited-English speakers, and senior individuals and families. Volunteers are IRS Tax Law certified and trained to provide the best quality tax preparation services.

Are you looking to get your 2025 taxes PREPARED?

REHOBOTH CDC’s VITA PROGRAM CAN HELP!

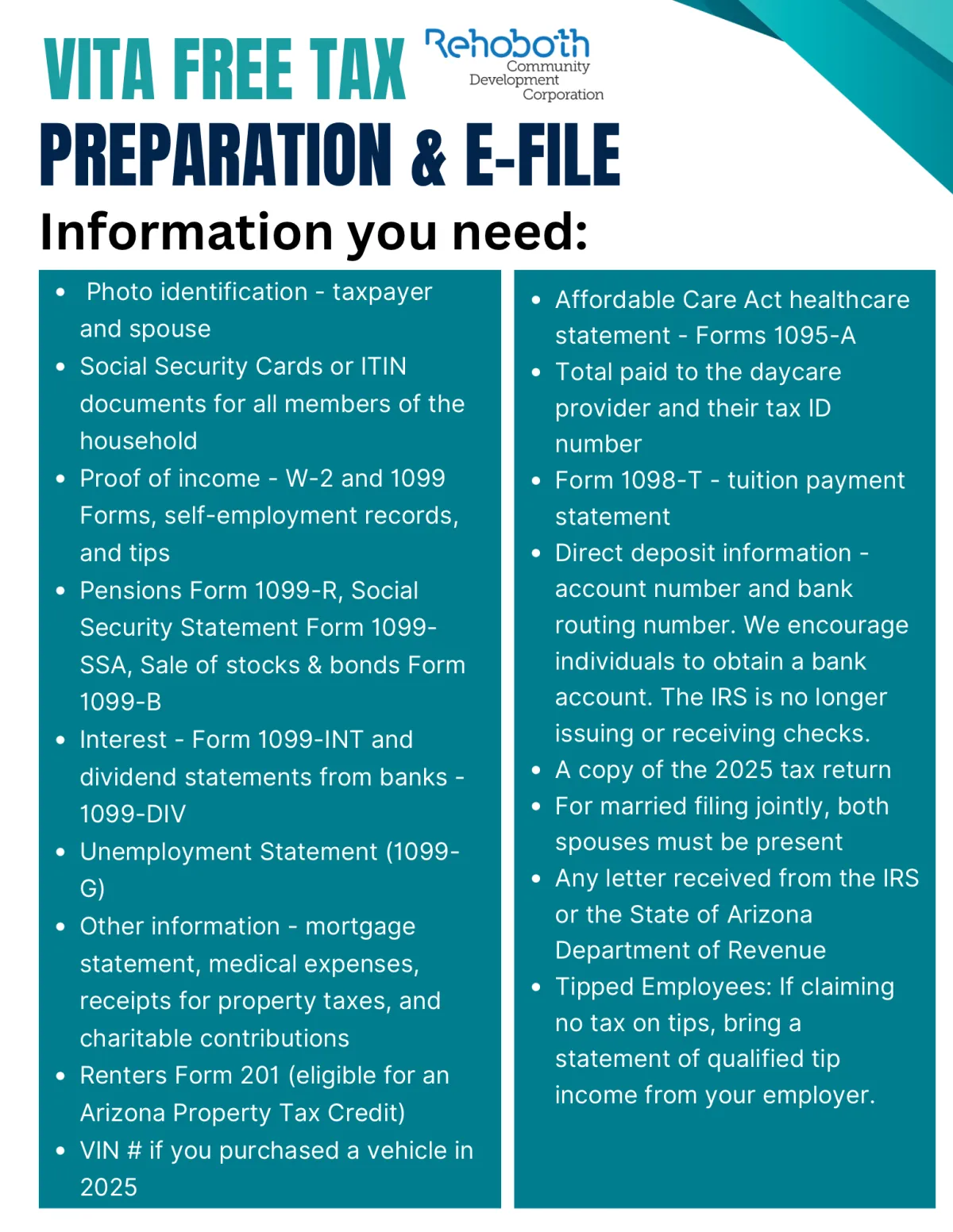

VITA FREE TAX PREPARATION & E-FILE

Would you like to make your appointment?

Important Information

The process will take about 1.5 hours.

We encourage you to have a bank account before arriving for tax preparation services. Bank On Arizona offers checking and savings accounts.

We encourage clients to prefill in 13614-c before arriving for appointments. You can locate the form with the following link below.

Don't worry, we can help!

Additional Links

Unreported wages and income can impact your tax return and may lead to penalties or delays if not properly addressed. It is important to understand what types of income must be reported and how to correct any missing or overlooked information before filing. Use the link below to learn more about unreported wages and income, what steps to take, and how to stay compliant with IRS requirements.

Are you looking for a VITA near you?

Free, trusted tax help is available through Volunteer Income Tax Assistance (VITA) locations in your area. VITA sites offer no-cost tax preparation and filing services for individuals and families who qualify, including those with low to moderate income, seniors, and individuals with disabilities. Certified IRS volunteers are available to help ensure your return is accurate and that you receive all eligible credits and refunds. Use the link below to find a VITA location near you and get the support you need this tax season.

Contact Us

602-272-4133

A Ministry of Rehoboth Saints Center, Inc. - a 501(c)3 nonprofit

© 2023 Rehoboth Community Development Corporation

P.O. Box 57601 • Phoenix, AZ 85079