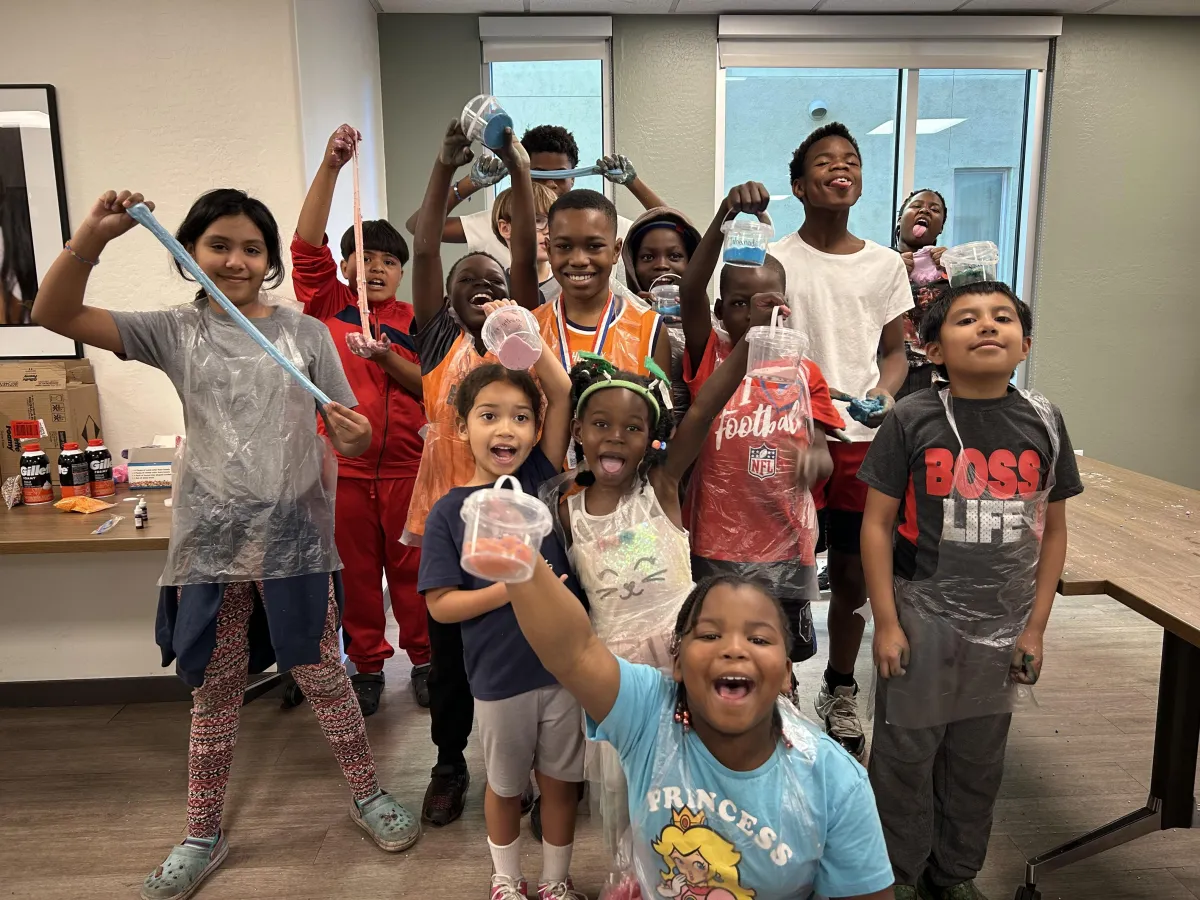

Learn About the Commitment of Rehoboth

The AZ Charitable Tax Donation

The Arizona Charitable Tax Credit is an incredible resource for taxpayers in the state of Arizona to make an impact in their local communities.

It allows taxpayers to make a charitable contribution to an eligible nonprofit and receive a dollar-for-dollar tax credit against their AZ state taxes.

Rehoboth CDC is a Qualified Charitable Organization.

2026 tax credit limits

Up to $506 for Single Filers or Heads of Household filing jointly

Up to 1,009 for married couples filing jointly

How to Claim Your Credit:

1. Make your donation to Rehoboth CDC by clicking the link below.

2. After you make your donation, you will receive your receipt immediately after. Save your receipt—you’ll need it when filing taxes.

3. Submit Form 321 with your Arizona state tax return.

4. Reduce your tax bill or increase your refund with your donation!

Ready to give? Click below to make your tax-credit donation today!

Have questions? Contact us at [email protected]

Contact Us

602-272-4133

A Ministry of Rehoboth Saints Center, Inc. - a 501(c)3 nonprofit

© 2023 Rehoboth Community Development Corporation

P.O. Box 57601 • Phoenix, AZ 85079